Jan 23, 2013

This week:

-

Why the Consolidation in Gold and Silver Markets is a Good Thing

-

Chinese Appetite for Gold Continues

-

Latest on Real Interest Rates in New Zealand

-

Well Known NZ Fund Manager Talks up Gold and Platinum

Why the Consolidation in Gold and Silver Markets is a Good Thing

Well not a massive change from a week ago in our 2 favourite metals, with range bound trading continuing. ?You can see in the charts below that both gold and silver are presently trading within large triangle formations which sooner or later they will both break out of. We think odds favour a resumption of the previous upwards trend when they do, but as ever only time will tell.

Looking at todays spot prices, gold sits at NZ$2016 and silver at NZ$38.41 per ounce. ?Gold is up $11 from a week ago or 0.55%. Whereas silver is up $0.93 which sounds more impressive in percentage terms ? being 2.48%. Quite a rise in a week and all without much fuss or attention.

This larger rise in silver saw the gold/silver ratio move down almost 1 point from a week ago to 52.57. And so it edges closer to?our near term target we mentioned last week of 50.?

In the long run (which it is turning into!) this consolidation in gold and silver will be a good thing in our opinion. As it will shake out the latecomers and leave the ?strong hands? and patient participants in the market. This will set us up nicely for the next move which Jim Sinclair wrote earlier today he believed would come??no later than midyear this year and running into 2017? The second phase of the long term bull market in gold should move faster and higher than any previous experience.?

Here?s to our patience being rewarded!?

Jim?s full post is worth a read. It?s headlined:?The Entrance To The Second Phase Of The Gold Market Ascendancy?

Last week we mentioned?3 factors that could send gold higher.

Here?s a quick update on developments in those 3 key areas in the past week with a link to a useful article on each point.

1. Currency Wars ? A further shot from the Japanese Central Bank with confirmation of their giving in to new Prime Minister Abe?s plan to increase their inflation target to 2% as talked about recently. Unfortunately not everyone can have a weak currency at once. So this really does look like a race to the bottom.

Read more at SMH.com.au

2. The?debt ceiling looks likely to get a 3 month reprieve?with Republicans looking to back a 3 month extension.?

3. And finally here?s a good article on?GoldSilver.com?covering the rationale behind the now confirmed German Repatriation of a portion of it?s gold reserves.

Other news of note this week was that?India has raised it?s gold import tax by 50%?(from 4% to 6%) to tackle India?s trade deficit.

Some pundits predict this will affect demand for bullion in India. The previous rise in import duties last year did dampen demand but seems to only have been temporary. These import duty increases could also be a factor why silver demand is rising in India, with gold getting more expensive some opt for silver instead.?

Chinese Appetite for Gold Continues

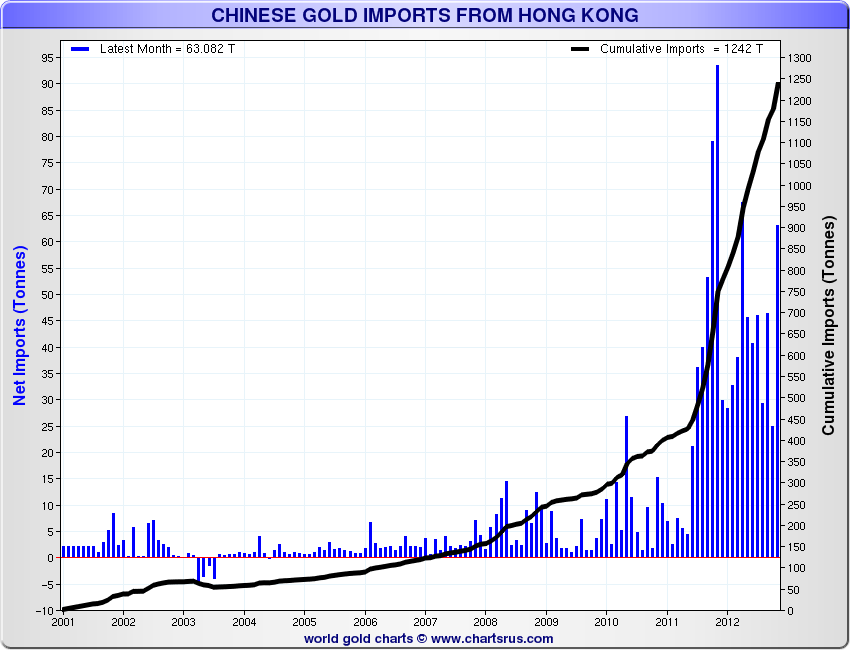

We have a feeling any dampening in demand in India could be made up for by Chinese buying. Zero Hedge reported that?China imported 91 tonnes of gold in November.?

This is a bit higher than the number reported by Nick Laird at Sharelynx.com of 63 tonnes. However these numbers are not official as they are based upon imports of gold into China via Hong Kong.?

So we?ll stick with Nick Lairds lower numbers as we believe he takes into account the ?re-importing? of gold into China. That is that some gold goes from China into Hong Kong and back again so if you just show the flow from Hong Kong to China without netting out the reverse you get an over estimate.?

Nicks chart is below. The black line shows cumulative imports ? note how they?ve really cranked up since mid 2011.

Whatever the exact number it seems China continues to buy an awful lot of gold and as ZeroHedge pointed out it seems China on a yearly basis is now spending more on gold than on buying US treasuries. Yet another reason why the Fed regardless of what they?ve been saying recently, will have to keep buying US government debt ? aka creating money from nothing for a long while yet.

We wonder when the next official announcement from China will come on the size of their gold reserves??

We read recently that Jim Rickards reckons it could come later in 2013 or 2014 where China will say they have now got 4000 tonnes of gold, thereby sending the price surging to $2500 to $3000.

This Weeks Articles:

This week we have one article and an interesting video on the site. See the links at the end of this email.

Latest on Real Interest Rates in New Zealand

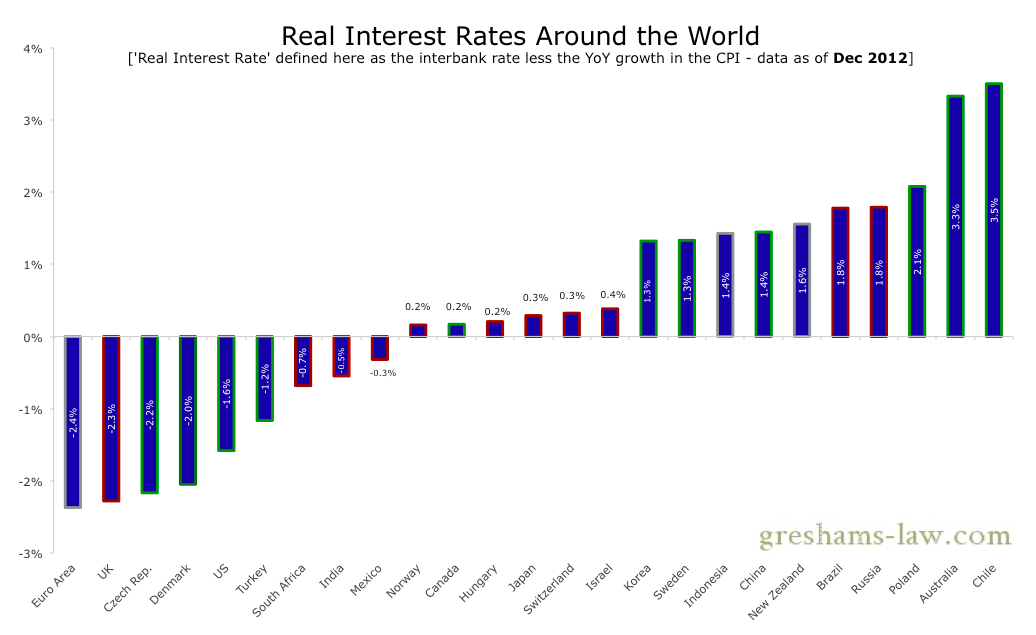

We?ve mentioned?Greshams-law.com?a few times before as they have some great articles and charts. This week they updated their?global real interest rates data.

The chart below shows real interest rates for 25 countries including NZ.

You can see NZ is over in the higher interest rate area (if you can call 1.6% high!). Of course bear in mind when viewing the chart that the real interest rate of each country is based upon the difference between the interbank lending rate and the year on year growth of each nations CPI. And of course the CPI is a government construct which is perhaps why many countries are still showing positive real interest rates. In case we need to spell it out ? the CPI is higher than what they say it is!

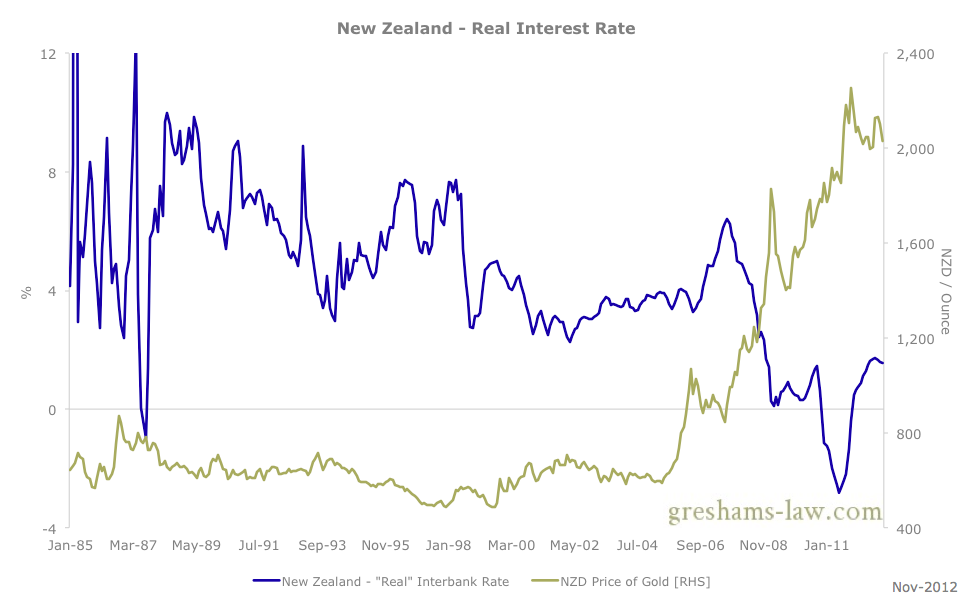

Now looking specifically at the historical rate for NZ, we can see that it doesn?t take the real interest rate to be negative for it to result in a rising gold price. But rather just a lower rate closer to zero than normal as occurred from around 2006.

(Note the big dip down below zero was a result of the increase in GST bumping up the change in CPI for the previous period.

Chart: NZ real interest rates and relationship to gold

So what to make of this?

With the announcement last week of negative CPI numbers for the December 2012 quarter, which drops the year on year NZ CPI down below 2%, this could prompt the RBNZ to cut rates further. This would keep the real interest rate down in the zone in which it currently sits. And likely continue to encourage more and more people to buy gold due to the low bank returns.

Well Known NZ Fund Manager Talks up Gold and Platinum

Speaking of being encouraged to buy gold. It was interesting to see well known Kiwisaver fund manager and founder of Fishers Funds, Carmel Fisher, talking up both gold and platinum in an article she penned on?gold and platinum on Stuff.co.nz?earlier in the week.

Although we don?t think she was quite right when discussing the platinum coin as a ?solution? to the US debt ceiling. Our understanding was that it could just be a small coin with $1 trillion stamped on it as face value. Not actually a coin made of a massive amount of platinum.

Anyhow it was interesting to see someone in what might be termed the ?mainstream? investment community even discussing gold in a positive light. She ended her article when discussing which one to buy ? gold or platinum ? like this:?

?Arguably, if we are heading for scary times and another recession, I should get my ring made in gold because it will hold its value better than platinum. But minting a trillion-dollar platinum coin would take out more than 10 per cent of annual platinum production, creating scarcity and therefore pushing the metal?s value up.

And of course, Treasury might not stop at $1 trillion ? why not mint enough coins to cover five years? worth of debt repayment?

Think I?ll get a bit of both ? what a nice way to hedge a bet.?

A bit of both is our own philosophy too but rather with gold and silver than gold and platinum.

Get in touch if you personally want some of either:

1. Email:?orders@goldsurvivalguide.co.nz

2. Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

3. or?Online order form?with indicative pricing?

Have a golden week!

Glenn (and David)

GoldSurvivalGuide.co.nz

Ph:?0800 888 465

From outside NZ:?+64 9 281 3898

email:?orders@goldsurvivalguide.co.nz

?

? ?

?![]()

This Weeks Articles:?

?

| 3 Factors That Could Take Gold Higher From Here |

|

This week: High Yawn Factor in Precious Metals Prices A Punt on the Gold/Silver Ratio 3 Factors That Could Take Gold Higher From Here Latest IMF Report on NZ Banking Risks High Yawn Factor in Precious Metals Prices The past week has not seen a great deal of action in precious metals land. Yawns all [...] |

| How Green Are Gold?s Blue-Chip Mining Stocks? |

|

Gold mining stocks or shares have definitely not been great performers in terms of share price appreciation for the past couple of years. This article takes a look at how they are performing in terms of cashflow, dividend yield and the like, compared to the average S&P500 company, to see whether they could be due [...] |

| 11 Silver Flashpoints |

|

Here?s a video from Chris Duane where he outlines 11 factors that might ignite the silver market. He has some very interesting views and his videos are always informative and easy to watch. This one covers areas such as: When procrastination silver buyers will rush in. Why silver retailers will sell out. Why smart silver [...] |

?

The Legal stuff ? Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

VN:F [1.9.18_1163]

Rating: 0.0/10 (0 votes cast)

VN:F [1.9.18_1163]

sanctum the notebook duke basketball miranda july joe paterno near death joepa sc primary

2013-01-16 00:16:16-05

2013-01-16 00:16:16-05 2013-01-21 20:57:22-05

2013-01-21 20:57:22-05 2013-01-22 21:02:13-05

2013-01-22 21:02:13-05

No comments:

Post a Comment